Earlier this month, Boris Johnson announced a new health and social care tax to fund reforms to the care sector and NHS funding. It is set to raise £36bn for front line services over the next three years.

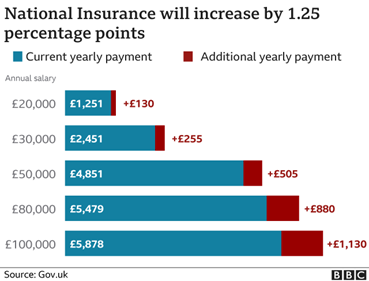

The tax will begin as a 1.25% rise in National Insurance from April 2022. It will be paid by both employers and employees. From 2023 it will become a separate tax on earned income, calculated in the same way as National Insurance and appearing on an employee’s payslip.

The Prime Minister also announced an equivalent increase to dividend tax to help cover social care costs.

What’s the purpose of the new tax?

The Prime Minister says that part of the £12bn a year will support the NHS to catch up on the backlog created by COVID-19, increasing hospital capacity for appointments, scans, and operations. The money will also go towards changes to the social care system. A new cap to care costs is to be introduced from October 2023. The maximum any individual will pay in care costs will be £86,000 over their lifetime.

Everyone with assets worth less than £20,000 will then have their care fully covered by the state. People with between £20,000 and £100,000 in assets will see their care costs subsidised.

What does the increase mean to working individuals?

As shown in the diagram below, taken from the BBC website, an individual earning £20,000 will now pay an additional £130 per year in National Insurance. Someone on a £50,000 salary will pay a further £505 per year.

What does it mean to employers?

Employers will need to re-budget to allow for these additional employer’s National Insurance costs. Note that existing reliefs on NICs, including the employment allowance, will also apply to the levy.

Some options to consider include:

- Exploring share option schemes rather than bonuses for higher earning employees.

- Salary sacrifice as an even more efficient way of making pension contributions – this reduces the salary on which employer and employee NICs are paid.

What does it mean to shareholders?

The equivalent increase to Dividend Tax will mean a similar impact to limited company owners and savers.

To mitigate this increase, small business owners could declare increased Dividends before April 2022.

To discuss how this change could impact you or your business, get in touch with us today.